The cabinet endorsed tax measures to boost tourism in second-tier tourism provinces during low season. Corporate tax can deduct expenses for 2 times for seminar. Tax payers can deduct up to 15,000 baht for guide tour and hotel fees.

Prime Minister Srettha Thavisin said the cabinet approved tax measures to promote domestic tourism, especially in the second-tier tourism provinces.

The government will lose 1.5 bn revenue

“It is expected that the implementation of the tax measures will cause the state to lose 1.5 billion baht. However, the measure is projected to stimulate spending in the tourism areas which can generate income in the cities more than the government’s revenue loss.”

He said the government planned to stimulate tourism in an effort to boost the economy to meet the goal by this year. The meeting recently among the economic team on June 3, 2024 agreed to implement various measures.

The tourism measures involved in supporting tourism in second- tier tourism provinces. The government will support related agencies to organize various festivals in secondary cities, especially during the low season.

“I told ministers that If they are good proposals in their provinces, please coordinate with the Tourism and Sports Ministry to help in order to implement the activities,” Mr Srettha said.

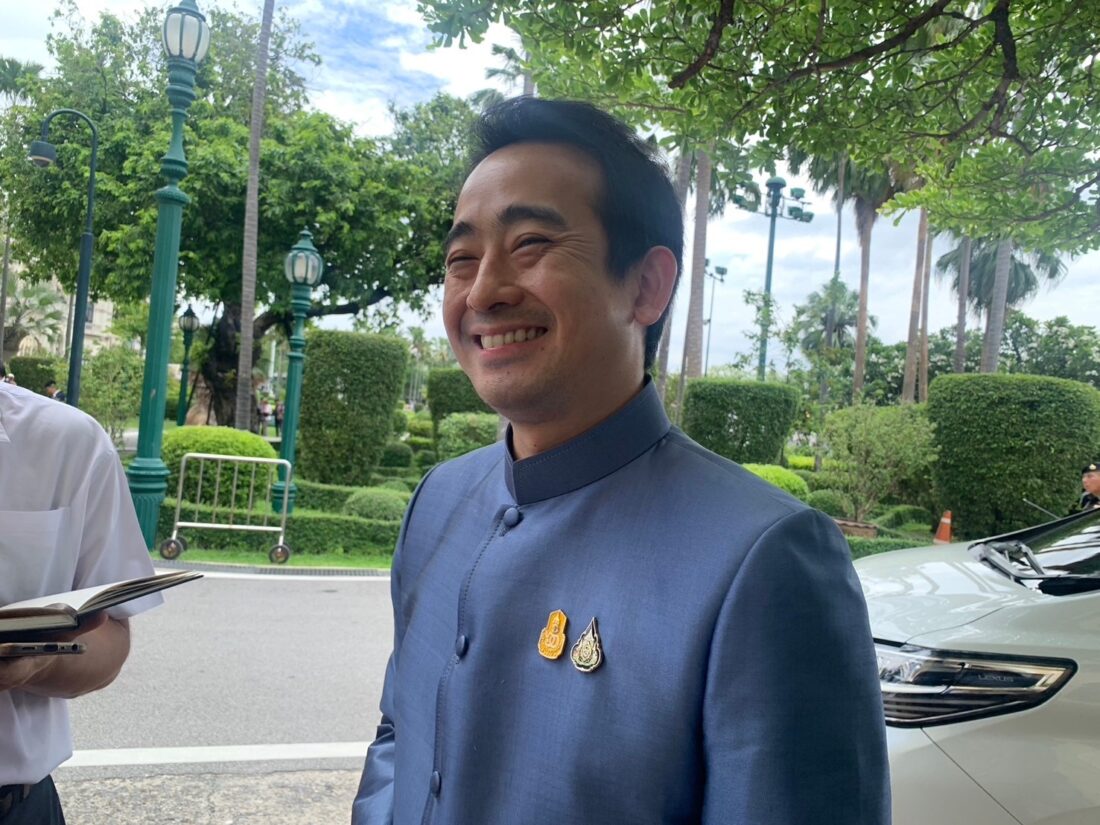

Deputy finance minister Paopoom Rojanasakul said that the cabinet approved two tax measures to stimulate revenue generation from tourism in the second-tier tourism provinces during low season.

The first is a tax measure to stimulate domestic tourism. Companies can deduct two times of expenses for corporate tax. The expenses are on room fees, logistic cost or other related expenses in the training programne or seminars held for employees in the second-tier tourism provinces. As well as service fees for tour operators for such training or seminars.

Companies can eligible a deduction for 1.5 times of expenses for the seminars in main tourism provinces.

The second is the tax measures to stimulate tourism in secondary cities for individuals. They eligible a deduction 15,000 baht for accommodation in hotel, Thai homestay for traveling in second-tier tourism provinces.

Implementing during 1 May – 30 November

Mr Paopoom said that the measures is implemented between May 1- 30 November by deducting it as an expense in tax calculations.

“Both measures must have a full tax invoice according to Section 86/4 of the Revenue Code in electronic form. The system of electronic tax invoices and electronic receipts ( e-Tax Invoice & e-Receipt).”

Two measures can stimulate travel to second-tier tourism provinces and stimulate tourism during low Season. This measure can be effective date back to May 1, 2024.

More additional measures next two weeks

Mr Paopoom said that the government is preparing to issue additional tourism measures. The ministry will propose additional measure to the cabinet over next two weeks. The measure will help both tourism and other industries.

Related News : Cabinet agreed to improve Thai visa system