Disrupt Technology Venture (“ Disrupt ”) announced the introduction of Disrupt Health Impact Fund with the first group of co-investment partners from leading Thai business companies.

They included the Digital Health Ventures (“DHV”), the innovation and venture arm of Samitivej Hospital Group, Thana Asset Company Limited (“THANA”), Saha Pathana Inter-Holding Public Company Limited (“SPI”) and Sripatum University (“SPU”).

Disrupt Health Impact Fund is dedicated in providing Thailand’s healthcare sector with access to world-class deep technology (DeepTech) and improving healthcare services for the Thai people.

Managed by an experienced team that oversees over 6 leading funds which have invested in 134 companies across 16 countries, the fund plans to invest in 15 DeepTech companies in the healthcare field, both domestically and internationally, within the next 3 to 5 years.

This initiative is expect to enhance the healthcare ecosystem, giving Thai people access to new, world-class health technologies. Disrupt Health Impact Fund is still open for partners to join and support Thailand’s development into a healthcare hub for Southeast Asia. The global HealthTech market is expect to grow by 10% annually, driven by various supportive factors.

The healthcare market, valued at over US$9 trillion

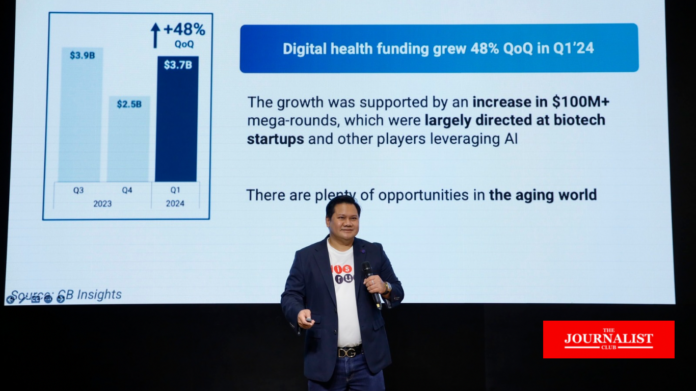

Mr Krating Poonpol, chairman of Disrupt Health Impact Fund, 500 TukTuks Fund and ORZON Ventures revealed “The healthcare market, valued at over US$9 trillion or more than 330 trillion Thai baht, represents a trillion-dollar industry and a mega trend that will gain even greater importance in the future.

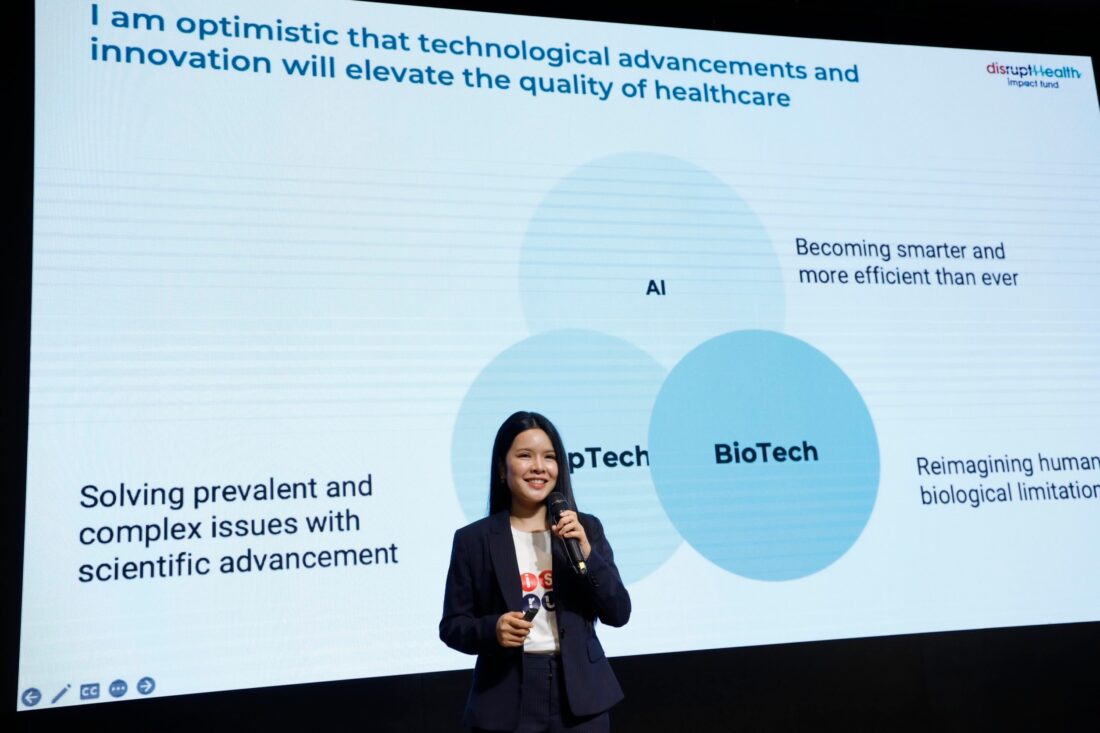

Thailand faces numerous healthcare challenges, presenting a compelling investment opportunity. This sector is further energize by technological advancements, particularly in AI and BioTech, which are driving innovative transformations and significantly enhancing the efficiency and distribution of healthcare access.”

Ms. Jantanarak Tuekaew, managing director of Disrupt Technology Venture (“Disrupt”) and Partner of Disrupt Health Impact Fund added that,

“there are also supporting factors from the increasing demand for healthcare solutions in an aging society,

along with the trend towards preventive physical and mental healthcare for people of all ages.

Thailand, earned global recognition for its healthcare services

Additionally, Thailand has earned global recognition for its healthcare services,

ranking among the top ten in the Global Health Security Index. The country also benefits from numerous opportunities in the medical tourism market. This presents an opportune moment for both Thai and foreign entrepreneurs to develop innovations that address future global challenges. Disrupt Health Impact Fund is ready to invest in

and support world-class innovations that can improve healthcare for the Thai people.

By collaborating with HealthTech companies, we aim to enhance and create a cooperative healthcare network within the country,

gaining access to global standard Deep Technology in healthcare.

In addition to providing investment, the fund aims to support the business expansion of DeepTech companies in the healthcare sector by leveraging healthcare expertise from both public and private sectors. This includes networking opportunities in pharmacy, product distribution, and in-depth research and studies through Disrupt ecosystem platform. Additionally, the investment expertise of Disrupt Health Impact Fund’s management team,

which has experience managing six funds and investing in a total of 134 startups across 16 countries, further enhances this support. Many of these startups are now preparing for IPOs, having been support from their early stages.

Disrupt Health Impact Fund for five key areas

Disrupt Health Impact Fund is committ to investing in five key areas: Self Care, Preventive Care, Silver Age, Holistic Wellness,

and Smart Hospital. The fund targets world-class innovations that are either in the market commercialization stage

or undergoing clinical trials to seek approval from the Food and Drug Administration (FDA). The initial investment typically ranges from US$500,000 to US$2 million per company. Furthermore,

if the companies in which Disrupt Health Impact Fund invests perform well and engage in business collaborations with co-investors,

there is an additional opportunity for these companies to receive direct investments from co-investors.

Related News : AEON partners with Major Cineplex to launch the “AEON M GEN VISA Credit Card”